Steps For Advance Tax Payments

Steps for Online Payment of Advance Tax

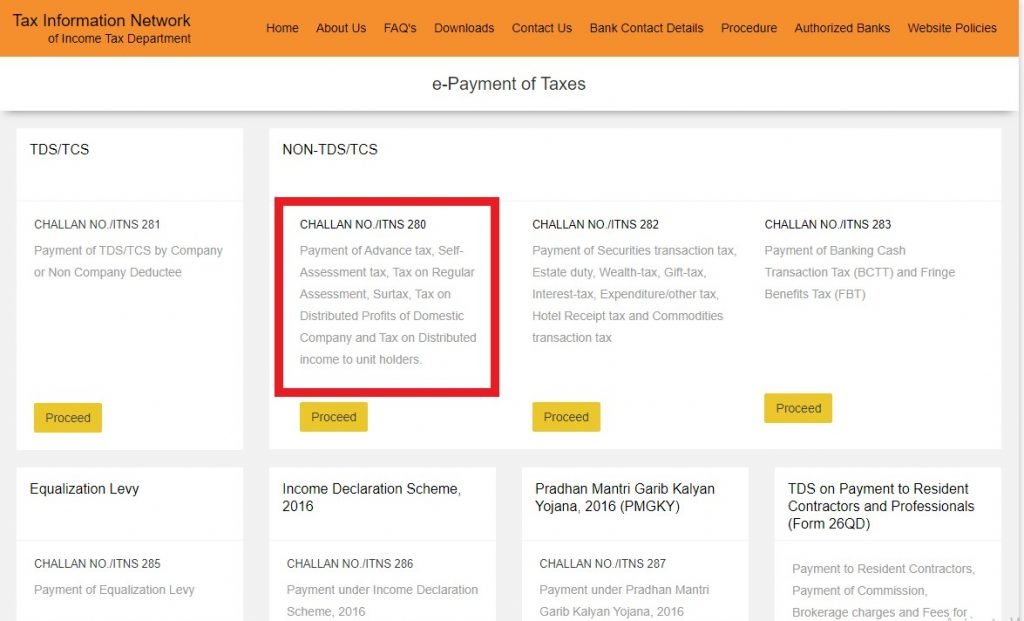

- Access the TIN NSDSL e-payment Portal.

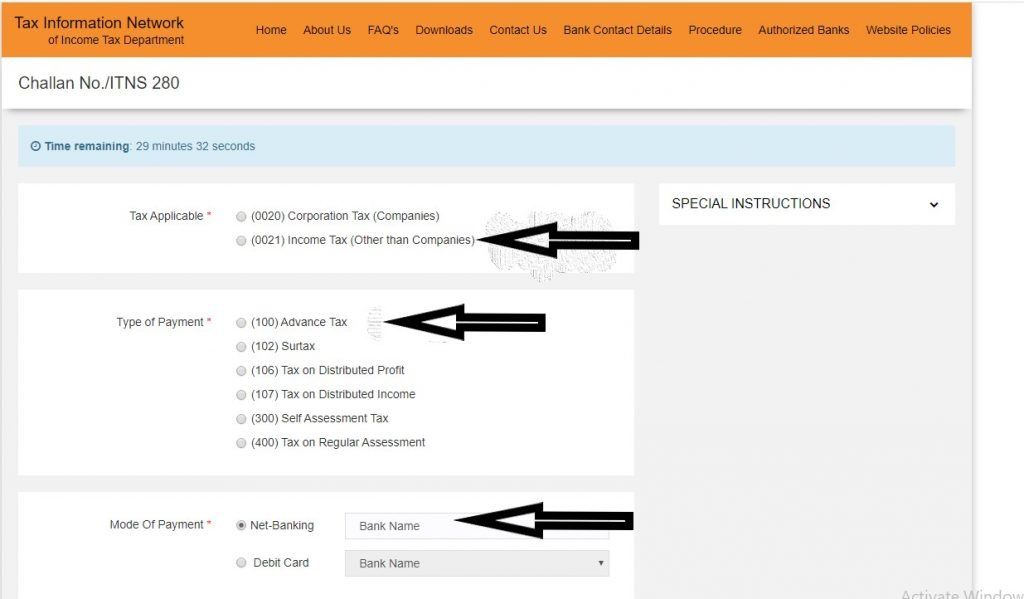

2. Select the tax applicable and Payment Type.

Select the Tax Applicable as (0021) Income Tax (Other than Companies). Later select the Type of payment as (100) Advance Tax.

3. Select the Mode of Payment and name of the Bank.

Next, select the mode of payment from the different options and the name of your Bank.

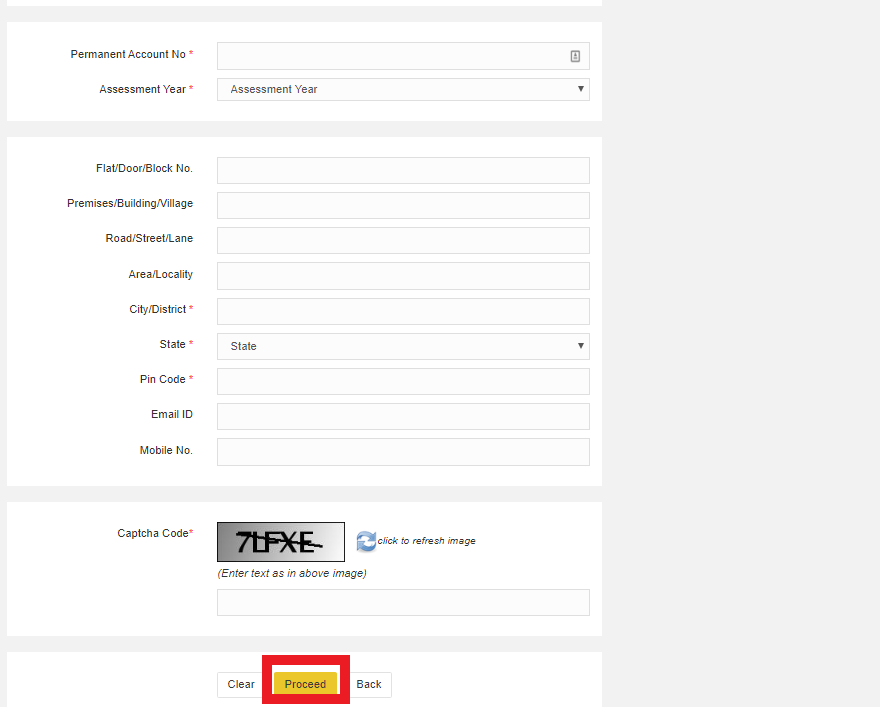

4. Enter the Details asked.

Enter PAN and Other Details including your email Id and contact number.

5. Select the Assessment Year.

After selecting the Assessment Year, enter the captcha and click on Proceed.

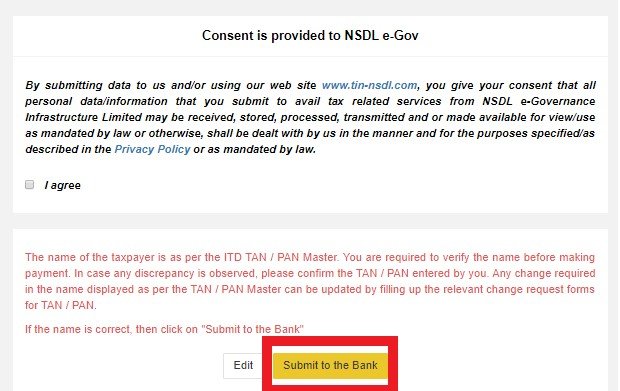

6. Click on “Submit to the bank”.

Verify the details that were entered and Click Submit.

7. Now you can log in to the net banking account of your bank to make the payment.

Once you make the payment you will get a challan counterfoil with Bank details. Save it for future reference.

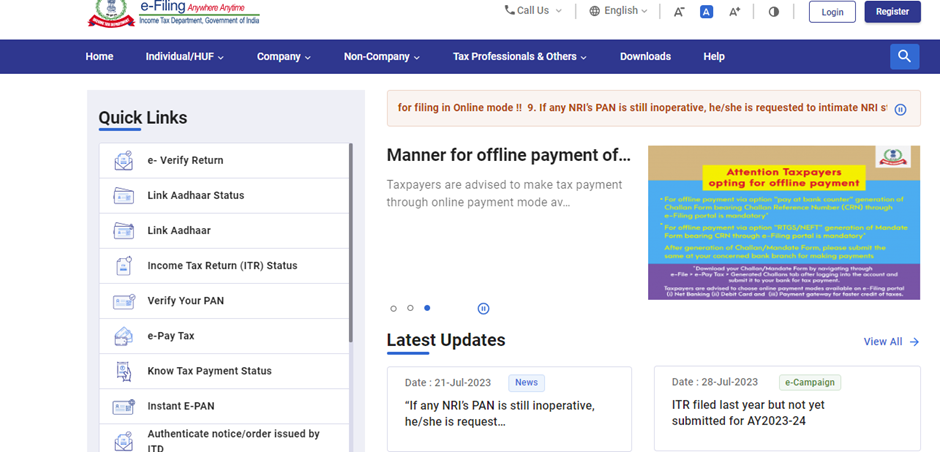

1.Click here to go to the website click here

2.If your Pan is Registered on the Income tax Portal. In that case, we can direct login from Login button. Which is Available on the top of the right side

3.If the pan is Not Registered then Please click on e pay tax.

4.enter pan in both columns and mob no (YOU CAN ENTER ANY MOBLE NUMBER NOT NECESSARILY ASSESSEE’S MOB NO)

5. Then you will get otp on the mob no which you entered

6.After Entering mob Otp. You will get this page.

7. Click on Continue and press proceed button

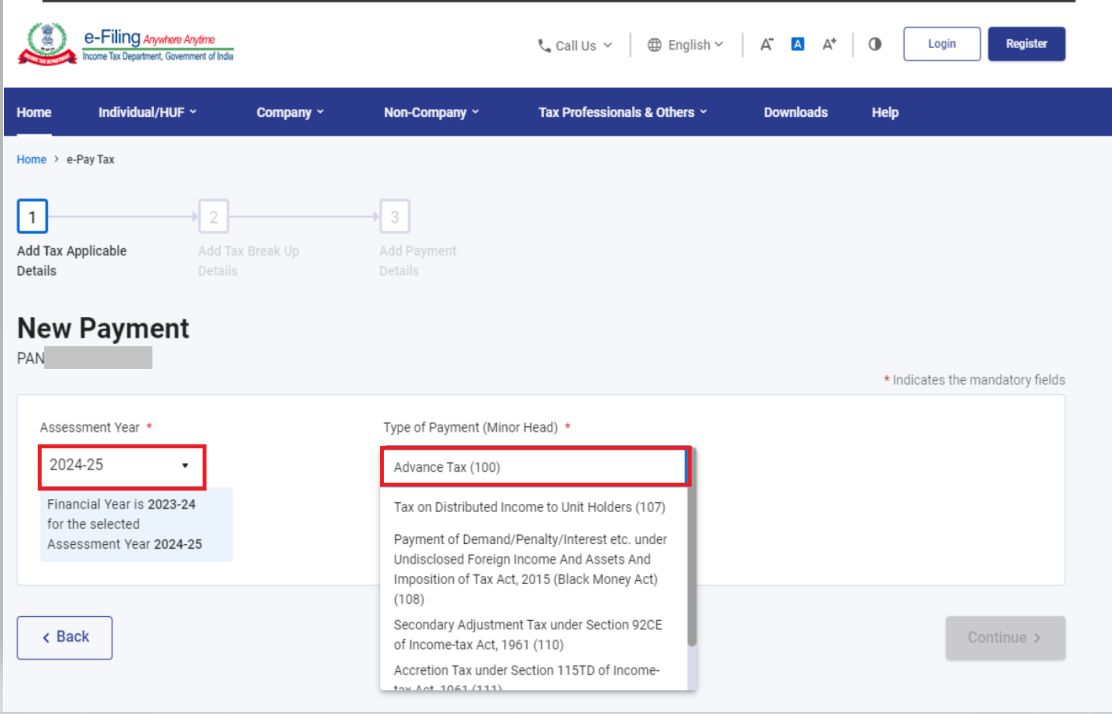

8.After That Select AY and select Advance tax(100).

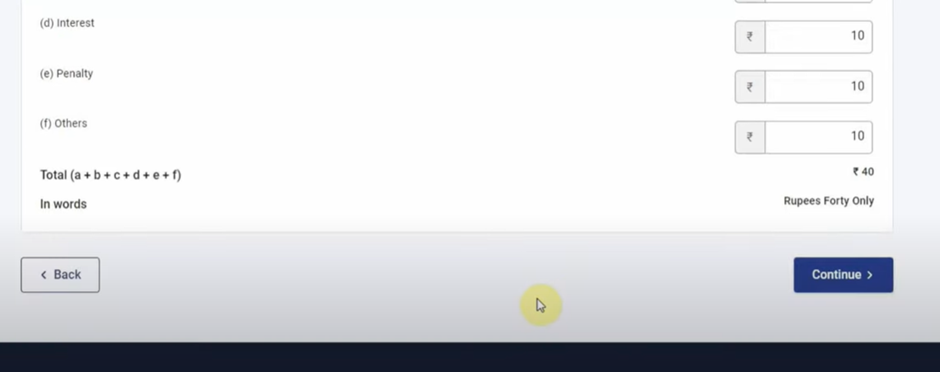

9. Then Enter Amt and click on continue.

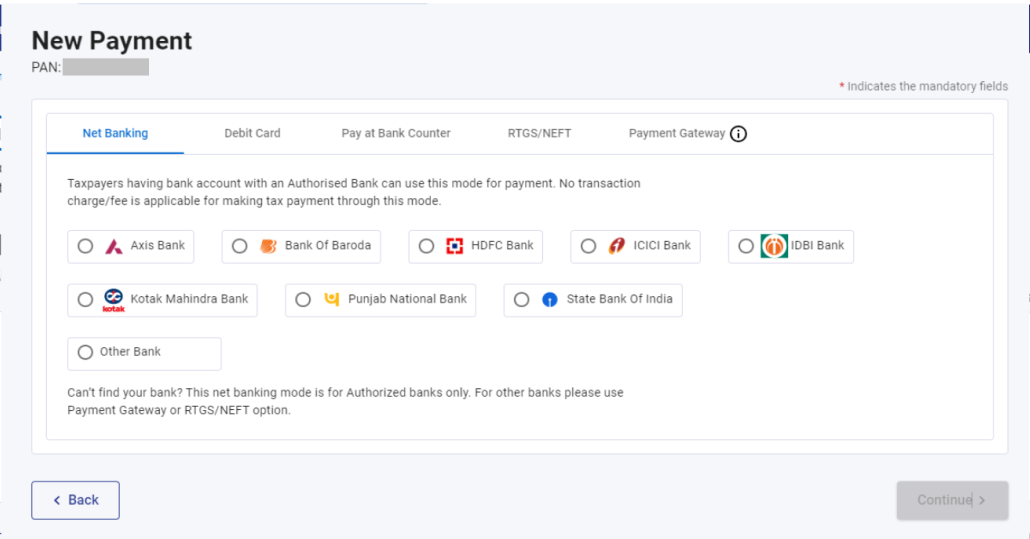

10.SELECT THE PAYMENT METHOD and click on continue.

11.preview the details and click on pay now