Steps For TDS Payments

Steps for Online Payment of TDS

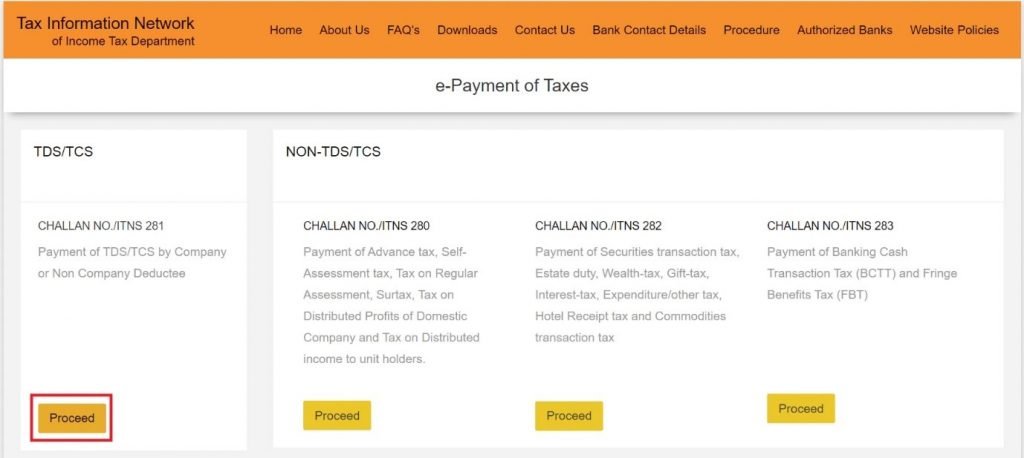

1. Access the TIN NSDSL e-payment Portal.

Visit the TIN NSDL e-payment portal and Select Challan no – 281

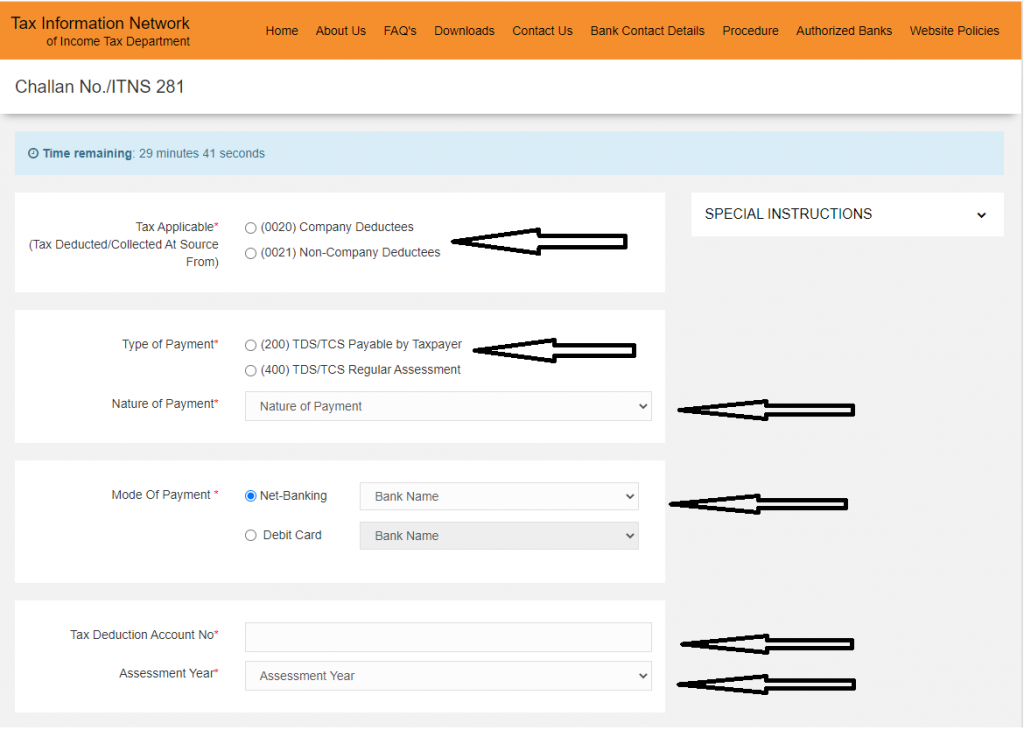

2. Fill in the required details

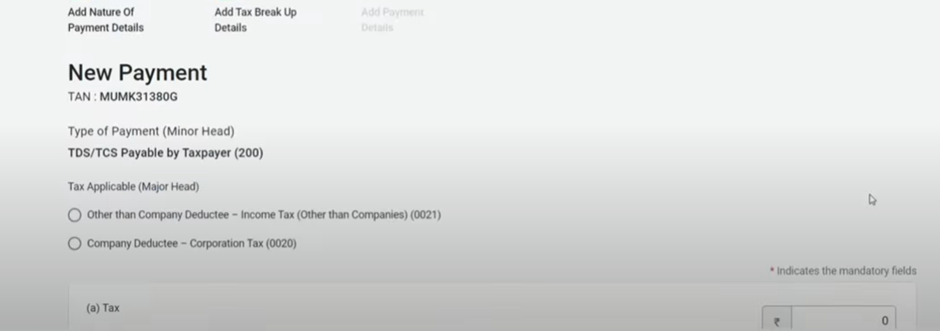

• If the deductee is a company then select ‘(0020) Company Deductee. But if a deductee is a person other than the company then select ‘(0021) Non-Company Deductees’.

• Then select the type of payment. If TDS/TCS is payable by the taxpayer by himself select ‘(200) TDS/TCS Payable by Taxpayer’. However, if TDS is payable via regular assessment as an outcome of a demand raised by the income tax department choose ‘(400) TDS/TCS Regular Assessment’.

• Select the type of payment on which TDS is to be paid.

• Choose a mode of payment such as Net Banking or Debit card.

• Enter your TAN details.

• Enter the relevant assessment year. For instance, tax for the income earned during the financial year 2022 – 2023 is payable in the assessment year 2023 – 2024.

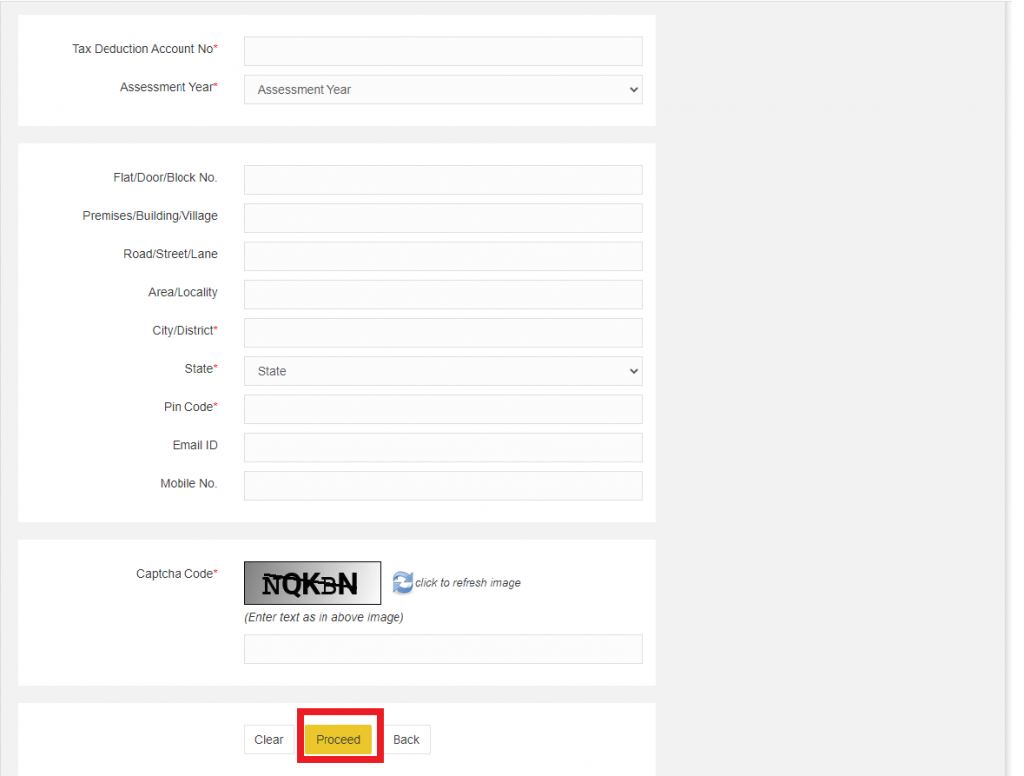

• Fill in other details like address, email id, mobile number, etc

• Enter the captcha code and hit proceed

3. Now you can log in to the net banking account of your bank to make the payment.

Once you make the payment you will get a challan counterfoil with Bank details. Save it for future reference.

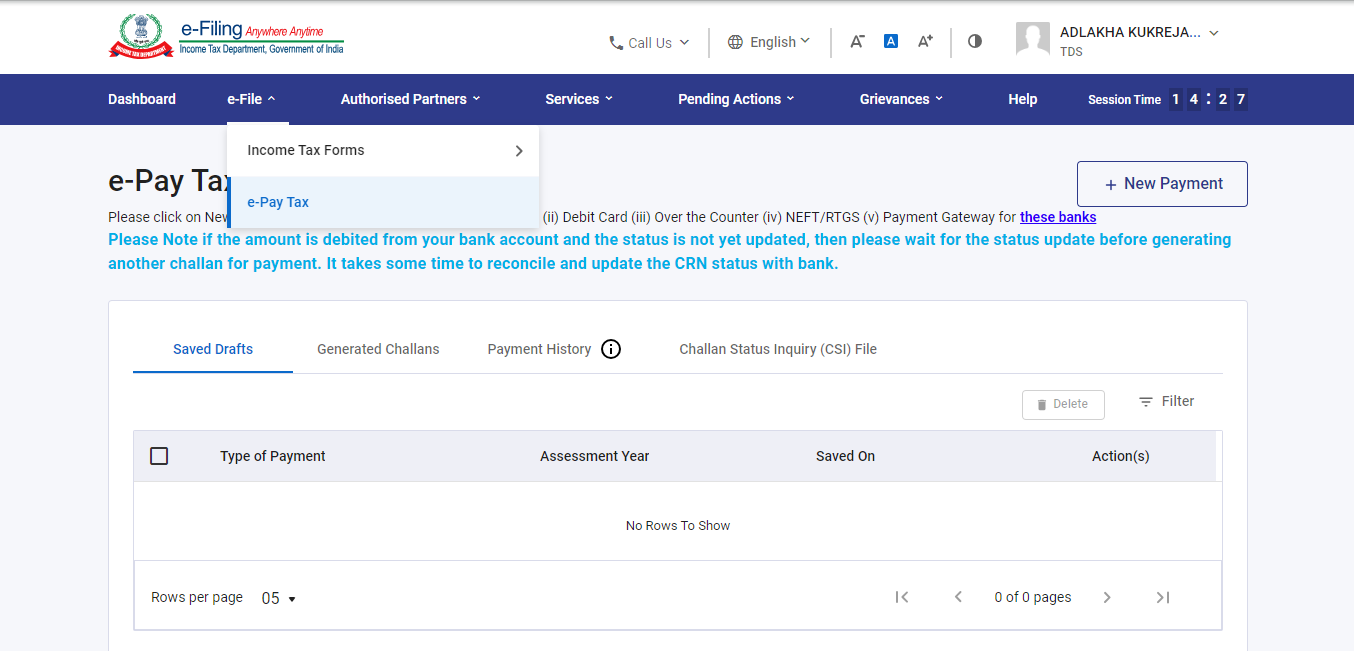

1. Open the Portal Click Here

2.If your Tan is Already Registered on the Income tax Portal then you can Direct Login. (TAN INCOME TAX LOGIN)

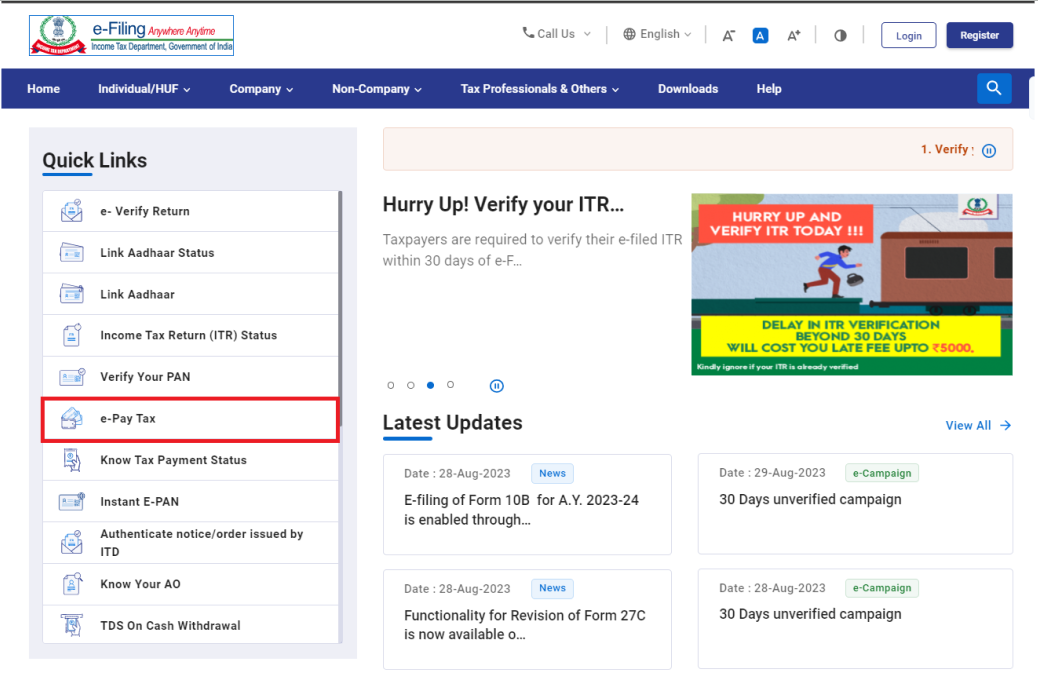

3.If Your Tan is Not Registered then please click on e-pay tax (quick links).

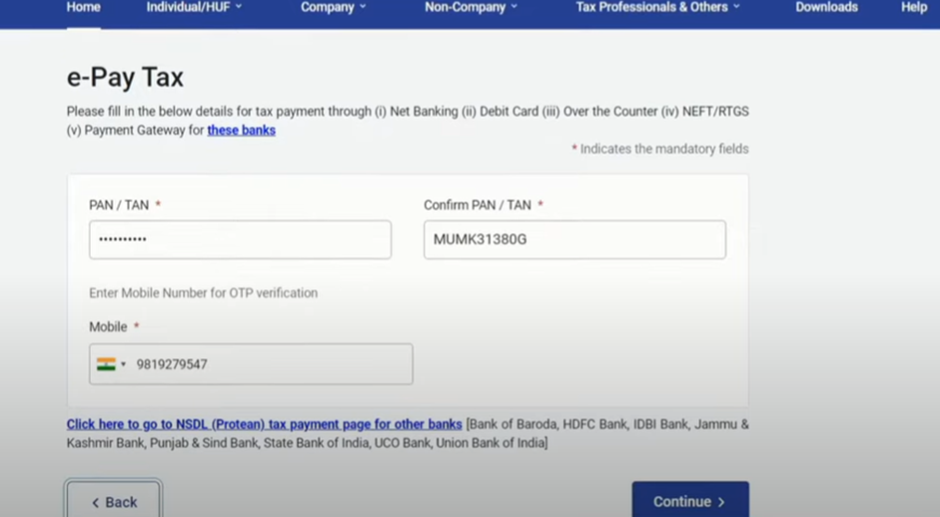

4. Then fill tan in both columns and mob no (you can enter any mobile number not necessarily assesses mob no) and click on continue.

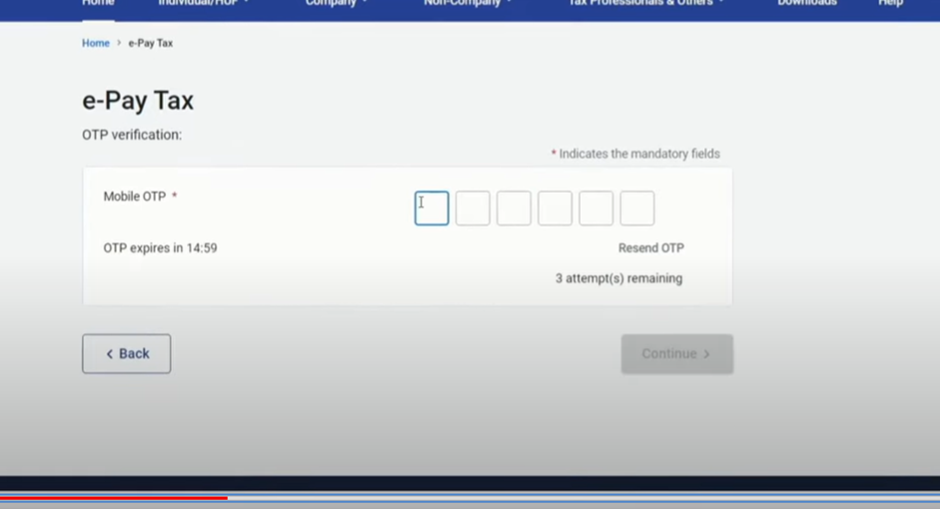

5. verify phone number.

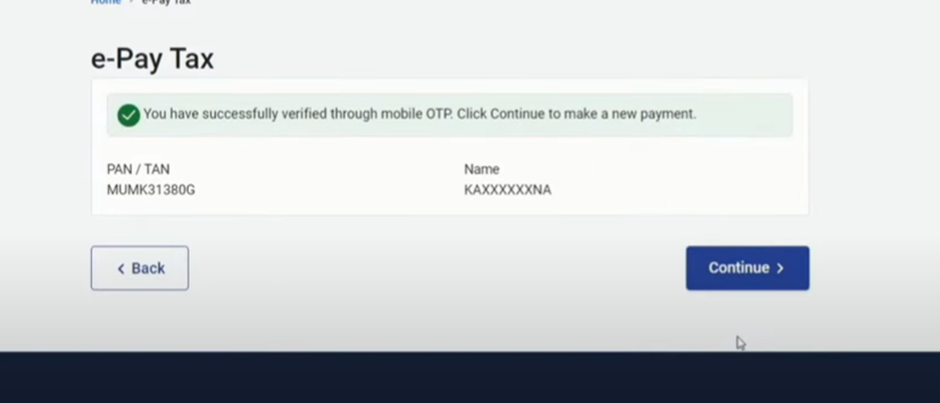

6. after entering OTP, you will be navigated to this page. CLICK ON CONTINUE.

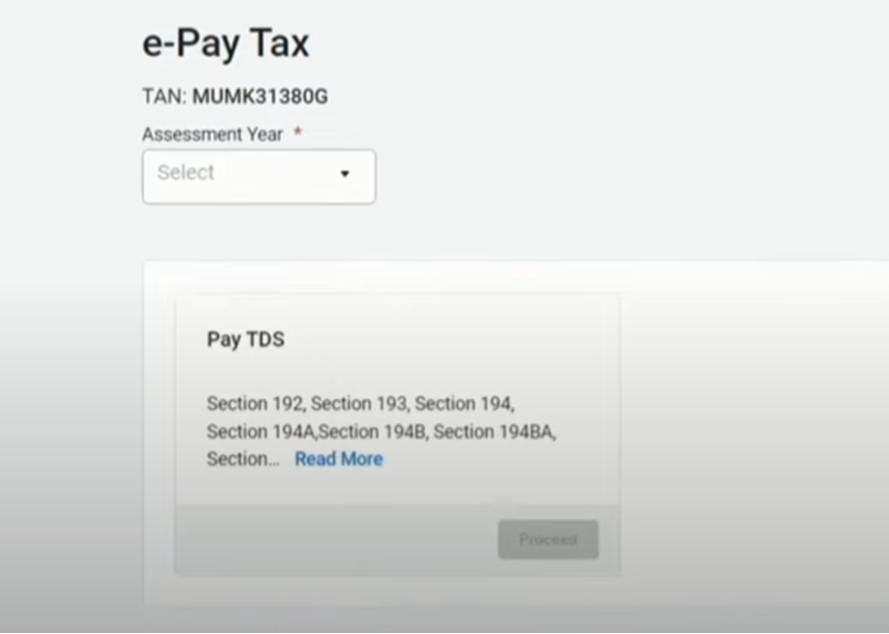

7.Then select AY And click on Proceed.

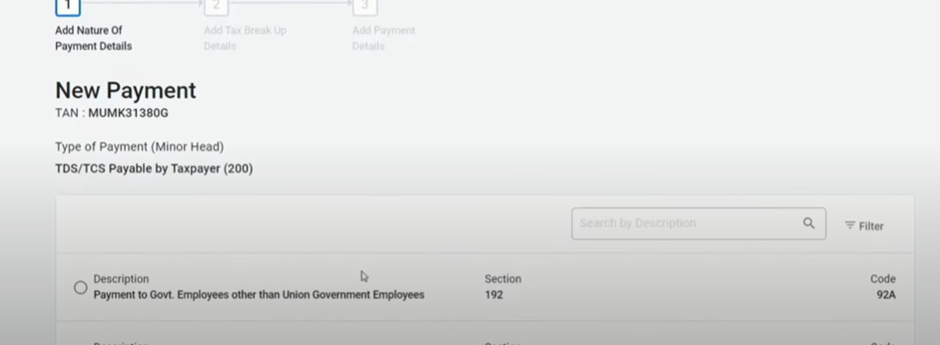

8. Then select section UNDER WHICH YOU WANT TO DEPOSIT TAX.

9.After that click on continue.

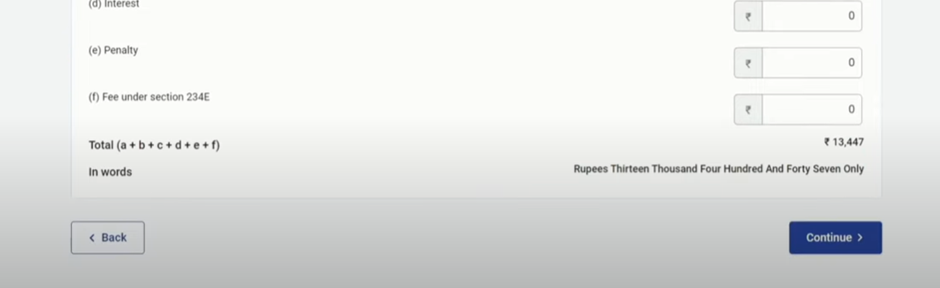

10.Then select major head and enter TDS Amount in column.

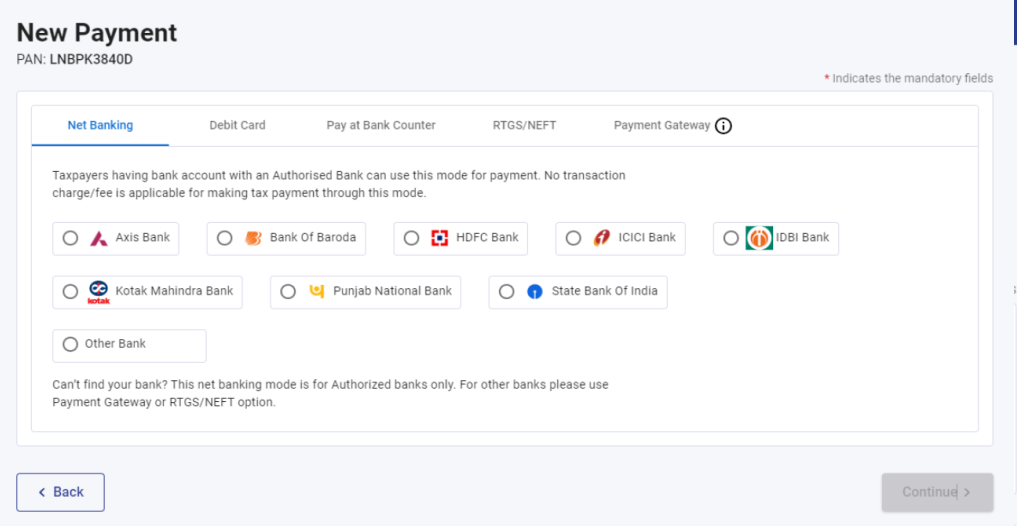

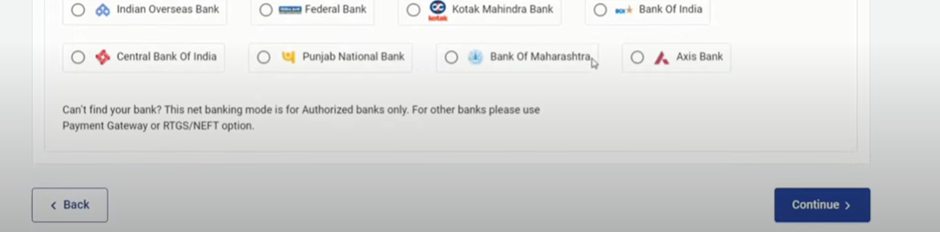

11. After Clicking on continue you will get this page. Now select the payment OPTION.

12.Click on continue.

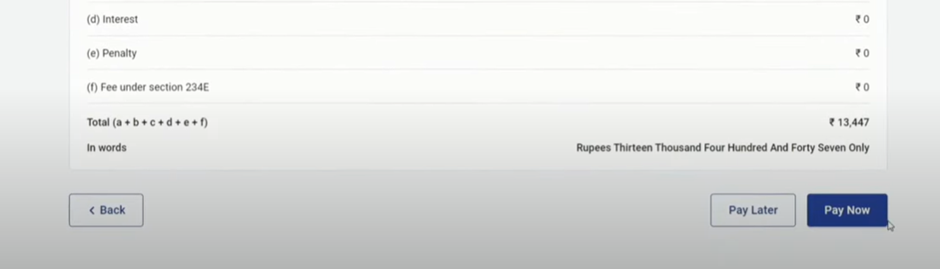

13.Then please check AY Section & amt and click on pay now.

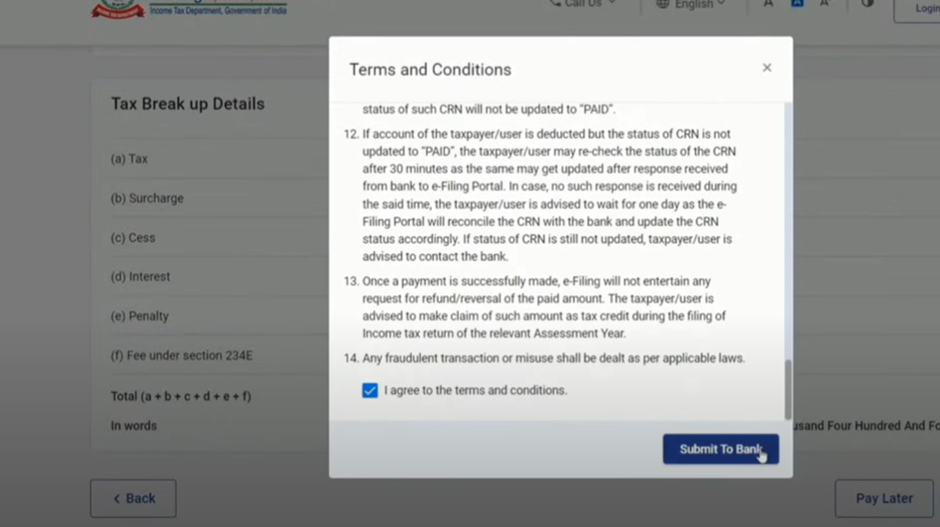

14.Then click on terms and conditions and submit to bank.