Section 43B MSME Payment Amendment and its implications

May 8, 2024

Principle of Natural Justice w.r.t Adjudication Process in GST

June 6, 2024

Are you curious about how e-invoicing can streamline your business operations and simplify tax compliance? Explore our FAQs for clarity! Simplify compliance and implementation effortlessly. Whether you’re a business owner, accountant, or tax professional, understanding e-invoicing is essential in today’s digital landscape. Embrace digital invoicing for streamlined transactions.

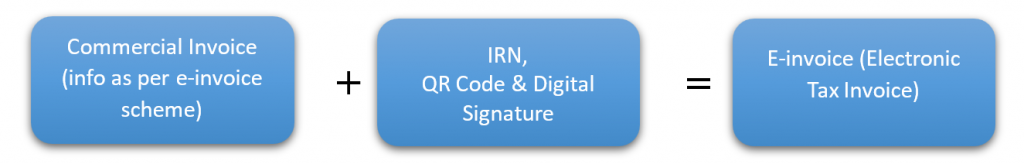

Q-1. What do you mean by E-invoicing?

Ans – E-invoicing, a system introduced under Indian GST law, is similar to the e-way bill process. It involves eligible taxpayers filling out tax invoice details to submit invoices or credit/debit notes in FORM INV-01, followed by the generation of an Invoice Reference Number (IRN) and QR code for each invoice via the Invoice Registration Portal (IRP). This process enhances invoicing efficiency and promotes transparency in tax compliance.

Q-2. What is the applicability of this provision?

Ans – The e-invoicing mandate applies to a registered entity whose aggregate turnover in any of the preceding financial year exceeds the specified limit. The implementation of e-invoicing provisions has been rolled out gradually as outlined below:

| Aggregate turnover limit | Applicability |

| 500 crores | 01st October 2020 |

| 100 crores | 01st January 2021 |

| 50 crores | 01st April 2021 |

| 20 crores | 01st April 2022 |

| 10 crores | 01st October 2022 |

| 5 crores | 01st August 2023 |

Though e-invoicing can be opted voluntarily also.

Q-3. If your entity’s aggregate turnover has crossed the prescribed threshold during the current financial year (e.g. during 2023-24). From which date e-invoicing would be applicable?

Ans – If aggregate turnover exceeds the prescribed limit in the current financial year, then e-invoicing would be applicable from the beginning of next financial year i.e. 1st April 2024.

Q-4. What are the exceptions to the applicability of e-invoicing?

Ans – The following are exempted from issuing e-invoice:

- Banking and Insurance sector

- Goods Transport Agency (GTA)

- Passenger Transport Service Supplier

- Admission to an exhibition of cinematographic films in Multiplex

- Special Economic Zone (SEZ) Units (though SEZ developers are not exempt)

Q-5. Are Free Trade & Warehousing Zones (FTWZ) exempt from e -invoicing?

Ans – Yes. As per Foreign Trade Policy, Free Trade & Warehousing Zones (FTWZ) are just a special category of Special Economic Zones (SEZ), with a focus on trading and warehousing which will be treated as deemed foreign territory within the geography of India for purpose of tariff and trade.

Q-6. What are the advantages of e-invoicing?

Ans – Several advantages are listed below:

- Consolidated reporting of B2B invoices during generation, reducing the need for reporting across multiple formats.

- Simplified generation of e-way bills using e-invoice data.

- Easier preparation of GSTR-1 filings as most data can be readily available through the e-invoicing system.

- Prevention of counterfeit (fake) invoices

- Minimal requirement for reconciling data between books and filed GST returns.

- Reduction of disputes among parties and improve payment cycles

Q-7. Can we generate a back dated invoice or by what date it should have been generated?

Ans – The answer is it depend on the Annual Aggregate Turnover (AATO) exceeds Rs 100 crores then taxpayers must generate e-invoices for tax invoice and credit/ debit notes within 30 days of invoice date. There is no defined time limit or period within which e-invoice must be generated for the rest. Therefore, It is advised to create e-invoice on or after the invoice date but before the filing of GSTR-1 returns.

Q-8. Can we cancel the e-invoice once generated?

Ans – Yes, an e-invoice can be cancelled within a period of 24 hours if certain errors were made during the time of generation of e-invoice. After expiry of 24 hours, it cannot be done on IRN portal.

Q-9. You have generated an IRN for an invoice, but due to discrepancies and the supply not materializing, you have cancelled it in your system. However, since the cancellation window on IRP has elapsed, you are unable to cancel the IRN. What should be done in this situation?

Ans – Once generated, IRN can be canceled within a 24-hour window. After lapse of 24 hours, no changes can be made. Therefore, the details of invoices actually issued have to be reported in GSTR-1. So, A Credit Note can be issued which will be reported to IRP for setting off the transaction.

Q-10. Does e-invoice need to be issued in all cases of supplies whether it is B2B, B2C, B2C – exports or B2B – Exempt?

Ans – In a nutshell, while e-invoicing may be mandatory for a registered entity, the issuance of an IRN (Invoice Reference Number) would not be necessary for either outward exempted supplies, nil rated supplies or supplies to unregistered customers. Following is the table summarizing different scenarios:

| Nature of Supply | Document | Applicability |

| B2B – Taxable | Invoice | Yes |

| B2B – Taxable | Credit/Debit note | Yes |

| B2C | Invoice | No |

| B2C | Credit/Debit note | No |

| B2C – Exports | Invoice | Yes |

| B2C – Exports | Credit/Debit note | Yes |

| B2B – Exempt | Bill of Supply | No |

Q-11. Whether IRN could be edited?

Ans – No, it is not possible so the only way out is to cancel the IRN and generate a new one with correct details.

Q-12. Is the Invoice number equivalent to the Invoice Reference Number (IRN)?

Ans – No, the Invoice number (e.g., ABC/1/2023-24) is assigned internally by the supplier and may vary in format across businesses, governed by GST rules. Conversely, the IRN is a unique reference number (hash) generated and provided by IRP upon successful registration of the e-invoice.

Q-13. Whether the financial/commercial credit notes also need to be reported to the IRP?

Ans – No, reporting is required only for credit and debit notes issued under Section 34 of the CGST/SGST Act.

Q-14. What data is embedded in QR Code?

Ans – The QR code will consist of GSTIN of Supplier, GSTIN of Recipient, Invoice number, as given by Supplier, Date of generation of invoice, Invoice value (taxable value and gross tax), Number of line items, HSN Code, Unique IRN (Invoice Reference Number) and IRN Generation Date.

Q-15. What does the term “dynamic QR Code” refer to, and does it hold any significance for B2B e-invoicing?

Ans – To comply, businesses must include a dynamic QR Code on B2C invoices; it’s clarified that displaying a Dynamic QR code digitally, with payment cross-reference, fulfills this requirement. Dynamic QR codes on GST invoices offer real-time updates, enabling transaction tracking, encouraging digital payments and compliance with GST regulations. The Dynamic QR Code has no relevance to B2B e-invoicing.

Q-16. Is e-invoicing applicable for invoices between two different GSTINs under same PAN?

Ans – E-invoicing by notified persons is mandated for supply of goods or services or both to a registered person. Persons having different GSTINs having same PAN will be treated as distinct persons. There is no exception provided to them.

Q-17. Does e-invoicing provision apply to Reverse charge mechanism (RCM) transactions?

Ans – Yes, e-invoicing applies to Reverse charge mechanism (RCM)

Q-18. Is it possible for IRP to reject a submitted invoice? What validations are conducted on the portal when reporting invoice details to IRP?

Ans – Yes, IRP can reject an invoice. It verifies if the same invoice has been previously recorded in the GST System using a unique combination of the Supplier’s GSTIN, Invoice Number, Type of Document, and Financial Year, which is also used for generating IRN. If a match is found, the invoice is rejected. Furthermore, additional validations are conducted on the portal; in case of failure, no IRN will be generated, and the invoice will get rejected with error codes explaining the reasons.

Q-19. Is e-invoice a substitute for the e-way bill?

Ans – No, the requirement to generate an e-way bill is different from generating an Invoice Reference Number (IRN) for a tax invoice, as they serve distinct purposes. An e-way bill remains necessary for the movement of goods via motorized conveyance. Thus, an e-invoice should be generated upon issuing the invoice, while the e-way bill should be issued at the commencement of goods movement. The e-way bill must be generated before the commencement of goods movement, even if it’s several months after the e-invoice generation.”

Q-20. If e-invoicing is applicable to the supplier and being a recipient, what are the consequences if I have tax invoice and not the e-invoice?

Ans – As a recipient, it is crucial to know if e-invoicing is applicable and if an e-invoice has been received, because ITC will be disallowed if there is only a tax invoice and not an e-invoice when applicable.

Q-21. As a recipient, how to know if e-invoicing is applicable or not?

Ans – Go to – https://einvoice1.gst.gov.in/Others/EinvEnabled and put GSTIN and you will get the information whether e-invoicing is applicable or not.

Q-22. Will the e-invoice details be automatically transferred to the GST System, and will they be included in the return?

Ans – Yes, once invoice details are successfully reported to IRP, the invoice data, including IRN, will be stored in the GST System. This information will be automatically populated into the supplier’s GSTR-1 and the respective receivers’ GSTR-2A.

You can always visit our website www.akcoindia.com/blog for reading such important information. And if you feel you need any assistance then you may just mail us at contact@akcoindia.com.

You may find our other blogs below:

Who should file an Income Tax Return (ITR)?: Click here

Old Tax Regime vs New Tax Regime: Click here

Relief to TDS Deductors wrt Inoperative PANs: Click here

Source Info: https://www.gst.gov.in/