Understanding New Capital gain Tax post Budget 2024

November 8, 2024

Budget 2025 Direct and Indirect Tax Changes

February 2, 2025In today’s dynamic business environment, choosing the right business structure is crucial for entrepreneurs and investors. Among the most common entities are Limited Liability Partnerships (LLPs) and Companies. Both structures offer distinct advantages and challenges, particularly when evaluated through the lens of ease of doing business. A company structure has existed in India for a long time. Limited Liability Partnership (LLP) business structure was introduced in India in 2008. Thus, Companies have existed longer than LLPs and enjoyed widespread recognition.

Over the past decade, India has made significant strides in simplifying business regulations and improving the overall business environment. In fact, India has jumped from 142nd place in 2014 to 63rd place in 2024 in the Ease of Doing Business rankings published by the World Bank. Understanding the nuances of both structures is essential for making an informed decision that aligns with a business’s goals and long-term vision.

What is a Limited Liability Partnership (LLP)?

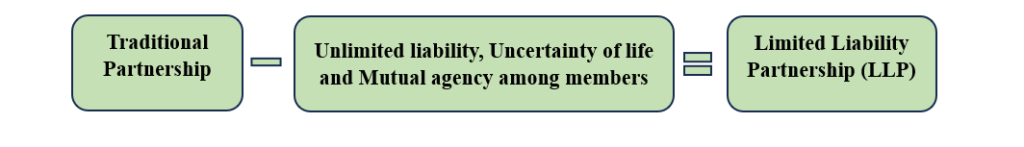

A Limited Liability Partnership (LLP) is a business entity that combines the best of two worlds—partnerships and limited liability. It provides operational flexibility, ease of operation, and tax benefits while maintaining a simplified compliance regime. In an LLP, the partner’s liability is limited to their agreed contribution to the LLP, thereby limited liability for the firm’s debts and obligations, shielding their personal assets from business risks. The LLP itself is considered a separate legal entity distinct from its partners. To form an LLP in India, a minimum of two partners is required, and there is no upper limit on the number of partners. If we compare to a partnership then we can look at this equation:

Key Features of LLPs:

- Limited Liability: Partners in an LLP have limited liability, meaning their personal assets are protected from the business’s debts and liabilities. This makes LLPs a safer option for entrepreneurs who want to minimize personal financial risk.

- Flexibility in Management: LLPs offer greater flexibility in management and decision-making, allowing partners to define their roles and responsibilities through mutual agreements.

- Partner’s Agreement: LLPs are governed by a partnership agreement outlining the partners’ rights, responsibilities, and obligations.

- Tax Benefits: LLPs are taxed like traditional partnerships. Profits are not subject to corporate tax, and there’s no double taxation on dividends, which is a big advantage over companies. Instead, profits are passed through to the partners, who report them on their individual tax returns.

- Ease of Compliance: LLPs are generally subject to fewer compliance requirements compared to companies, making them less cumbersome to manage from an administrative point of view.

- Loans and Funding: LLPs can raise loans more easily than traditional partnerships, but they can’t issue shares or raise equity capital in the same way that companies can, which can be a limitation for fast-growing businesses. LLPs cannot issue shares, which means they do not have the option to raise capital through share issuance at a premium or any other pricing model.

- Suitability: LLP is suitable for startups, traders, and small to medium-sized businesses that do not require much external funding.

What is a Company?

According to Section 2 (20) of the Company Act 2013, Company means a company incorporated under this Act or any previous Company Law. In general, a company is an artificial person, created by law that has a separate legal entity, perpetual succession, and common seal and has limited liability. It is a voluntary association of person who together contributes in the capital of the company to do business. There are different types of companies, such as Private limited, Public limited, and One-Person companies (OPCs), but they all share some common features.

Key Features of Companies

- Incorporated Association: A company comes into existence through the operation of law. Therefore, its incorporation under the Companies Act is must. Without such registration, no company can come into existence.

- Limited Liability: Similar to LLPs, companies also provide limited liability protection to their shareholders, which means that shareholders are not personally liable for the company’s debts.

- Minimum members: A Private Limited Company requires at least 2 members, while a Public Limited Company needs a minimum of 7 members. A One Person Company (OPC) requires only 1 member, catering to solo entrepreneurs.

- Minimum Directors: A Private Limited Company requires a minimum of 2 directors, while a Public Limited Company must have at least 3 directors. A One Person Company (OPC) requires only 1 director, aligning with its single-member structure.

- Perpetual Existence: A company has perpetual existence, meaning it continues to exist even if ownership or management changes. This provides stability and longevity, which can be essential for large-scale operations and growth-oriented businesses.

- Access to Capital: Companies have a significant advantage when it comes to raising funds. They can issue shares to the public or private investors, making it easier to attract capital. Additionally, companies can offer Employee Stock Options (ESOPs) to attract and retain talent.

- Double Taxation: Unlike LLPs, companies face double taxation—first on their profits at the corporate tax rate, and then when dividends are distributed to shareholders, they are taxed again at the individual level.

- More Stringent Compliance: Companies are subject to more stringent regulatory requirements, such as mandatory audits, board meetings, and regular filings with the Registrar of Companies (ROC). The penalties for non-compliance can be harsh and financially burdensome.

- Management and Ownership: A company is not managed by all members but by their elected representatives called Directors. Thus, management and ownership are different.

- Transferability of Shares: Shares of a company are freely transferable in case of public company. Transfer of shares of private companies is regulated by Articles of Association.

Similarities Between a Company and an LLP

Key Differences Between LLPs and Companies

| Aspect | LLP | Company |

| Incorporation | Incorporated under provision of LLP Act, 2008 | Incorporated under provisions of Companies Act, 2013 |

| Ease of Incorporation | Simple and cost-effective, fewer legal formalities, faster process. | More complex, stringent legal requirements, longer and more expensive. |

| Compliance Requirements | Fewer obligations, no mandatory annual or board meetings, simpler filing. Audits only for turnover > ₹40 lakhs or contributions > ₹25 lakhs. | Strict compliance regime, annual filings, audits, board meetings, severe penalties for non-compliance. |

| Taxation | Taxed as partnerships, profits passed through to partners, no DDT, avoids double taxation. | Subject to corporate tax rates, dividends taxed again, leading to double taxation. |

| Raising Capital | Cannot issue shares, limited ability to raise equity capital. | Can issue shares, greater flexibility to access capital markets, can offer ESOPs. |

| Management and Control | Partners have direct say in management and decision-making, hands-on approach. | Managed by a board of directors, shareholders have limited control over daily operations. |

| Perpetual Existence | Can be terminated if partners mutually agree, less stable. | Perpetual succession, continues indefinitely regardless of changes in ownership or management. |

| Scaling Challenges | Coordination and decision-making among partners | Maintaining efficient governance and shareholder alignment |

| Compounding Penalties | Compounding penalties are managed by the NCLT/ RD with fines up to ₹25 lakhs | Compounding penalties are handled by the Central Government with generally lower fines. |

LLPs vs. Companies: Role in India’s Ease of Doing Business

India’s journey from 142nd to 63rd in the Ease of Doing Business rankings has been fueled by key reforms that streamline business operations. In India, both Limited Liability Partnerships (LLPs) and Companies play crucial roles in fostering an environment conducive to business growth. The LLP structure, with its simpler compliance framework and tax benefits, is especially beneficial for startups and small businesses. LLPs allow entrepreneurs to focus on growth rather than navigating complex regulations, aligning perfectly with the government’s vision to promote ease of doing business. For larger, more established companies, the reforms have also simplified procedures, but the compliance and tax burdens remain higher compared to LLPs. That said, companies offer greater potential for scalability, access to capital, and global expansion, greater transparency and investor confidence making them an ideal choice for businesses aiming for significant growth. Together, both structures offer flexibility, catering to different business needs, and contributing to India’s improving ease of doing business.

Conclusion

When considering the ease of doing business, the choice between a Company and a Limited Liability Partnership (LLP) can significantly impact the regulatory, financial, and operational aspects of your business. Basically, the choice depends largely on your business’s size, goals, and long-term vision. Companies, whether private or public, are characterized by their ability to raise funds, limited liability protection, and a structured management system. Private companies restrict share transfer and limit the number of shareholders, while public companies can have unlimited members and the option to list shares. On the other hand, LLPs offer a blend of partnership flexibility and corporate benefits, such as limited liability. They are particularly favoured for their simpler, flexible structure with fewer compliance requirements and tax advantages, making them a less burdensome option for entrepreneurs. LLPs are ideal for smaller businesses, startups or professional service form who require a formal structure but wish to avoid the rigors of corporate formalities. However, it’s crucial to note that some states have restrictions on the types of professions that can form an LLP. The decision between a Company and an LLP should align with your business goals, the industry you’re operating in, and the scale of operations you envision. For instance, if you’re looking to rapidly expand and potentially go public, a Company might be the better option. Conversely, if you’re seeking simplicity in compliance and operations with a focus on professional services, an LLP could be more suitable.

To conclude, both LLPs and Companies have their unique strengths. It is about choosing the one that aligns with your business vision and ambitions.

You can always visit our website www.akcoindia.com/blog for reading such important information. And if you feel you need any assistance then you may just mail us at contact@akcoindia.com.

You may find our other blogs below:

Who should file an Income Tax Return (ITR)?: Click here

Old Tax Regime vs New Tax Regime: Click here

Key Highlights of Union Budget 2024: Click here

Source Info: https://incometax.gov.in/