Steps For GST Payments

Process for GST payment

1. Access the https://www.gst.gov.in/ URL. The GST Home page is displayed

2. log in to the GST Portal with valid credentials

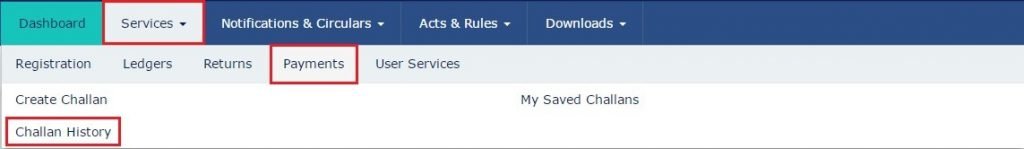

3. Access the generated challan. Click the Services > Payments > Challan History command

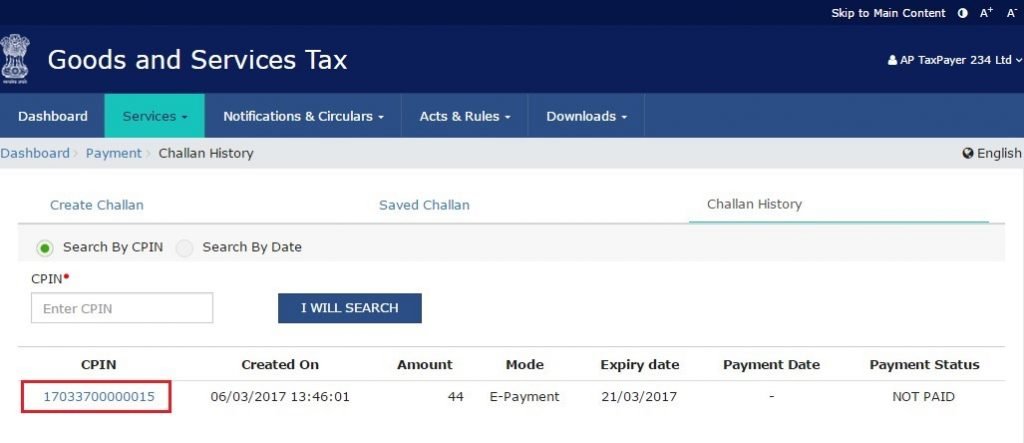

4. Select the CPIN link for which you want to make the payment.

Note: In case you don’t know the CPIN number, you can select the Search By Date option to search the CPIN number by date on which it was generated.

5. Select the Mode of E-Payment.

In the case of E-Payment

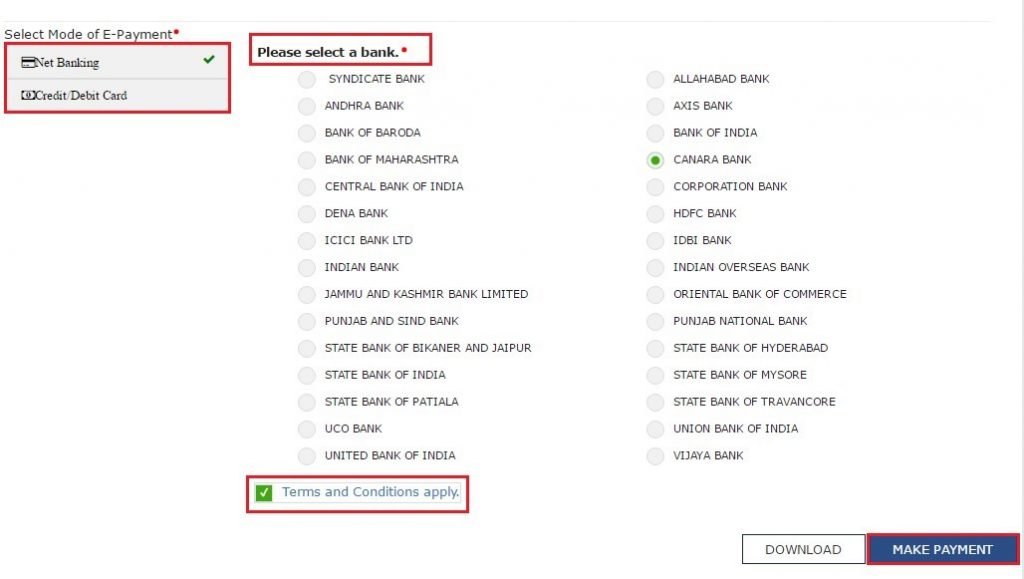

In the case of Net Banking

a. Select the Bank through which you want to make the payment.

b. Select the checkbox for Terms and Conditions apply.

c. Click the MAKE PAYMENT button

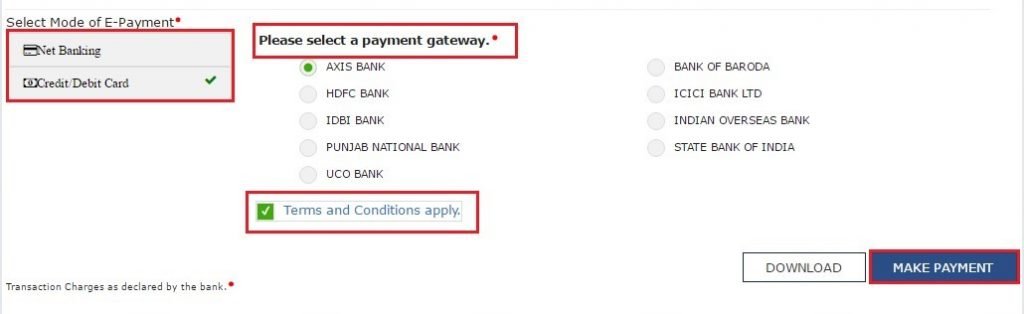

In the case of Credit/ Debit Cards

In the case of Credit/ Debit Cards

a. Select a payment gateway, and select the payment gateway option.

b. Select the checkbox for Terms and Conditions apply.

c. Click the MAKE PAYMENT button

Note: You will be directed to the Net Banking page of the selected Bank. The payment amount is shown on the Bank’s website. If you want to change the amount, cancel the transaction and create a new challan.

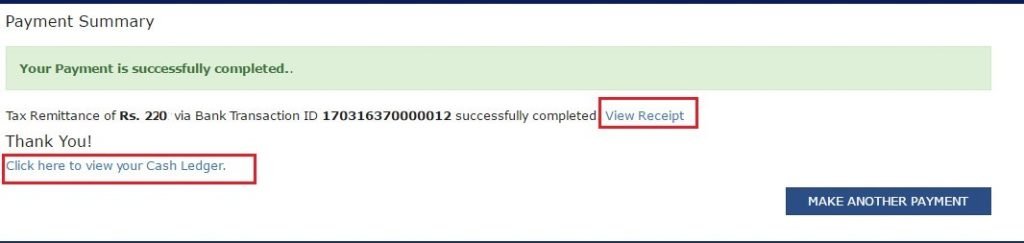

In case of successful payment, you will be re-directed to the GST Portal where the transaction status will be displayed. The payment receipt is displayed.

• To view the receipt, click the View Receipt link.

• You can also make another payment by clicking the MAKE ANOTHER PAYMENT button.

• You can view the Electronic Cash ledger by clicking the Click here to view your Cash Ledger link.

In the case of Over the Counter

a. In the Payment Modes option, select the Over the Counter as a payment mode.

b. Select the Name of the Bank where cash or instrument is proposed to be deposited.

c. Select the type of instrument as Cash/ Cheque/ Demand Draft.

d. Click the GENERATE CHALLAN button.

e. Take a printout of the Challan and visit the selected Bank.

f. Pay using Cash/ Cheque/ Demand Draft within the Challan’s validity period.

g. Status of the payment will be updated on the GST Portal after confirmation from the Bank.

In the case of NEFT/ RTGS

a. In the Payment Modes option, select the NEFT/RTGS as a payment mode.

b. In the Remitting Bank drop-down list, select the name of the remitting bank.

c. Click the GENERATE CHALLAN button.

d. Take a printout of the Challan and visit the selected Bank. Mandate form will also be generated simultaneously.

e. Pay using Cheque through your account with the selected Bank/ Branch. You can also pay using the account debit facility.

f. The transaction will be processed by the Bank and RBI shall confirm the same within <2 hours>.

g. Once you receive the Unique Transaction Number (UTR) on your registered e-mail or mobile number, you can link the UTR with the NEFT/RTGS CPIN on the GST Portal. Go to Challan History and click the CPIN link. Enter the UTR and link it with the NEFT/RTGS payment.

h. Status of the payment will be updated on the GST Portal after confirmation from the Bank.

i. The payment will be updated in the Electronic Cash Ledger in respective minor/major heads.